Fundrise: Real Estate Investing, Built for You.

Rating: 0.00 (Votes:

0)

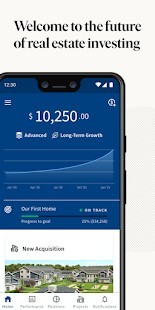

Invest in something real.

Private real estate offers the unique potential to earn consistent cash flow through income and long-term growth through appreciation. Fundrise has acquired and actively managed more than 200 assets collectively worth more than $4.7 billion on behalf of Fundrise investors.

Flexible investment minimums.

Unlike most private real estate investments, our low investment minimum gives you the flexibility to invest the right amount of money for you, on your schedule, to meet your financial goals.

Maximize returns with our low-fee approach.

Fees matter. That's why our proprietary technology and unique low-fee model are designed to ensure you keep more of what you earn.

Next-level diversification.

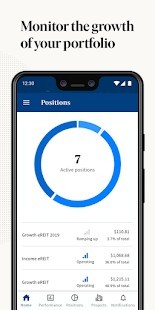

We believe that smart diversification is critical to long-term wealth creation and preservation. We make it easy to diversify beyond stocks and bonds, outside the stock market. Diversifying is simple and helps you minimize asset correlation and portfolio risk as your investment portfolio gains immediate exposure to dozens of high-quality private market assets.

A mission of transparency.

Within minutes of investing, you can watch as your dollars are diversified. Through your investor newsfeed, you can watch as each asset in your investment portfolio progresses, including developments such as new construction updates, occupancy reports, market data trends, and project completions.

Bank-level security.

Fundrise uses bank-level security for your protection. Investor information is encrypted with bank-level AES encryption. Two-factor authentication is available to all investors, and app users have access to the added layer of protection available through Face Unlock and fingerprint authentication.

Hyper-responsive support.

Our dedicated team of knowledgeable financial professionals in our Washington DC headquarters is available via email or phone to answer your questions or help with your account.

Award-Winning Company.

✓ Fundrise has been repeatedly recognized by Forbes as one of the 50 most innovative fintech companies in the US.

✓ Fundrise was ranked in the Inc. 5000 list of the fastest-growing private companies in America in 2018 and 2019.

Getting started is quick and easy.

Signing up with Fundrise is simple and only takes a few minutes. Fundrise integrates with more than 3,500 banks including Chase, Wells Fargo, and Charles Schwab — with no complicated paperwork required.

1. Decide how much money to invest.

Unique benefits are unlocked at different account levels.

2. Select your strategy.

Cash flow? Appreciation? A balance of both? You set the strategy, we do the rest.

3. Grow your portfolio.

Build your net worth by continuing to invest over time.

Disclosures

Fundrise Advisors, LLC is an SEC-registered investment advisor. Registration with the SEC does not imply a certain level of skill or training. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Before investing, consider your investment objectives and Fundrise’s charges and expenses. Nothing in this material should be construed as investment or tax advice, or a solicitation or offer, or recommendation, to buy or sell any security. All images and return figures shown are for illustrative purposes only, and are not actual customer or model returns. Visit fundrise.com/oc for offering documents and other information.

User ReviewsAdd Comment & Review

Based on 0

Votes and 0 User Reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

Other Apps in This Category